6 Minutes

6 Minutes

6 Reasons Fintech Companies Need Business Intelligence

From digital banking to international payment transfers, the global fintech market is growing at an annual growth rate of over 24% and is slated to reach nearly $310 billion by 2022

In 2019 itself, over $135.7 billion were invested globally spread across 2,693 deals into fintech companies. The future for fintech has never looked brighter.

However, competition in the sector is also increasing at a rapid rate with new startups flushed with venture capital entering the space as well as big banks throwing their hats into the ring.

From DBS Bank’s Accelerator program focused on Fintech investing to technology firms like Grab (originally a ride-sharing company) entering the digital banking space, the race for faster growth and innovation has never been more furious.

Due to the nature of the industry, fintech is at the forefront of innovation. But that also means companies will be facing an ever-changing landscape with new obstacles and challenges.

Fintech Companies Face A Set Of Unique Challenge

While fintech companies are known to be on the cutting edge of technology, they face unique challenges that get greater the more successful they become.

The first is building trust with customers.

Because security is a big concern with users of fintech solutions where their money is concerned, companies will have to stay on top of their operations and preemptively ensure no breach occurs.

Another is the growing push for regulations from governments globally to ensure transactions, from money transfers to investments, are regulated to prevent incidents of money-laundering and digital theft.

Regulators around the world are pushing for greater KYC checks on customers that can be terribly inefficient and a drain on company resources.

Perhaps one of the biggest challenges is the fact that fintech companies are fighting against entrenched opponents in an industry that is highly resistant to change.

From international banks to gigantic insurance companies, fintech companies are battling against the spending power of these corporations and their willingness to market far and wide to grab the attention of their customers.

Coupled with the trying-task of trying to mold and shape user behavior and getting them to take on more risk, fintech companies will have to use every resource available to them to make smart and ideally data-driven decisions.

The stakes are big and the margin for error is small.

Thankfully, fintech companies can continue to stay innovative and ahead of the competition by unlocking the power of the data within their very own organization through business intelligence.

6 Reasons For Fintech Companies To Adopt & Embrace Business Intelligence

Business intelligence (BI) is a solution that mines and analyzes a company’s data, helping deliver actionable insights to the user.

And it is these insights that will help optimize the operations of fintech companies, ensuring they can make swift data-driven decisions to capitalize on opportunities as well as avoiding serious regulatory and financial risk.

1. BI Helps Companies Better Understand Their Customers’ Needs

From digital banking solutions to Robo-investing platforms, fintech is transforming the way people are seeking to protect and grow their money.

Because margins for each transaction here are typically thinner compared to traditional banking facilities, it is important for fintech firms to identify the best performing services (as well as the most popular) to capture a bigger market share and encourage more transactions from existing customers.

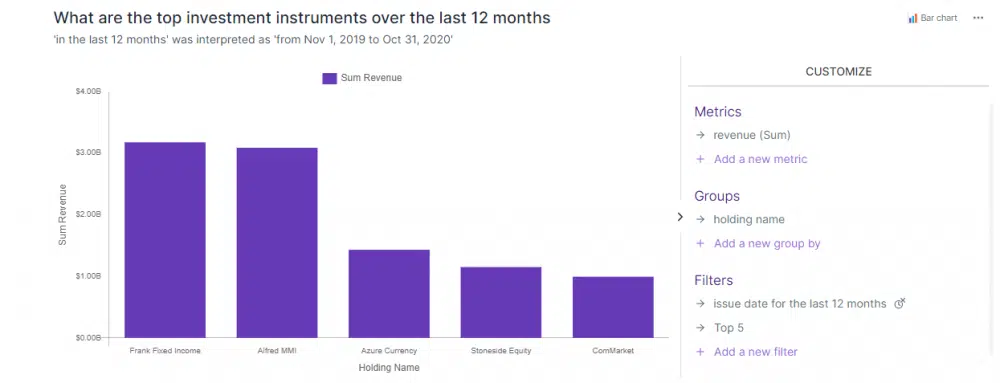

Business intelligence allows fintech firms, especially in investing, to ask an important conversation with data

“ What are the investment instruments that show the most revenue growth in the last 12 months?”

This allows fintech companies to actively innovate around these insights and market better to their users to win more business.

2. BI helps with Detecting Suspicious Activities

As the customer base of a fintech solution grows, fintech companies generate more data such as user behavior.

One key application of this ability is to track suspicious activity that is occurring on your platform, allowing you to detect potentially fraudulent activity that might cause regulatory issues such as money laundering.

A robust business intelligence solution will allow you to gain insights into key user behavior metrics and risk indicators such as:

- Huge sums of money being transferred

- Frequent transfers from multiple accounts to a single account

And matching them to other dimensions such as the nature and size of a business.

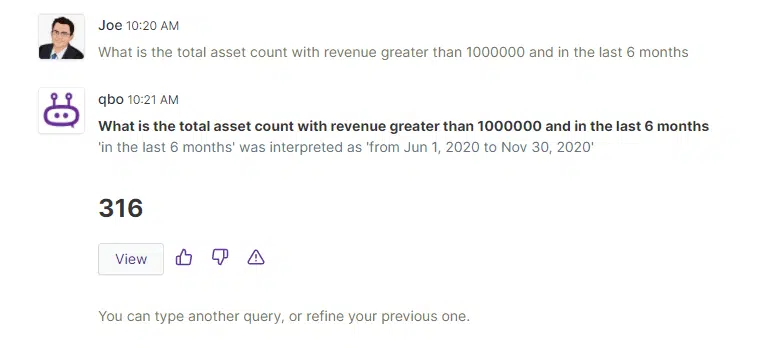

Through business intelligence, powered by conversational analytics, leaders and investigators can ask questions such as “How many transactions exceeding $10 million were done over the last six months?”.

3. BI helps to Uncover & Diagnose Cybersecurity Issues

Using business intelligence, data leaders can effectively analyze their data to uncover patterns, irregularities and discover any weaknesses within a network that will need attention.

When financial transactions are involved, prevention is better than cure.

Take the recent Robinhood investment app hacking which saw 2,000 accounts being looted as well as a 5-hour outage on their app due to the stresses on their infrastructure.

Incidents such as this not only tarnished the reputation of the company but also results in a loss of market share in a fiercely competitive environment.

With Business Intelligence, organizations can use insights derived from historical data and combine it with real-time analysis to detect if there are any anomalies present.

4. BI helps Companies Increase their Margins & Bottom-line

The investing game is tough with margins getting continuously squeezed by competitors and the traditional banks.

Business intelligence allows leaders to gain insights on-demand on the way they are pricing their commissions and charges.

This is especially important when companies are looking to win new businesses and might offer promotional discounts that could increase revenue but hurt their bottom lines.

This represents a huge opportunity for companies in Robo-investing, with a predicted $4.6 trillion being managed by these AI firms by 2022, to optimize their margins to maximize profits in a highly competitive industry.

5. BI helps to Deliver a more Intuitive & User-Friendly Experience

Traditional banking and financial services aren’t exactly known to be customer friendly.

From long waiting times to outdated and confusing website interfaces, the promise of fintech has always been to better serve customers better – and that extends to offering a pleasant experience on their platforms.

Business intelligence allows companies to analyze a whole spectrum of their customer journey throughout their solution.

From the moment prospects interact with their advertisements to creating a demo account on their platform, a good business intelligence tool will allow leaders to immediately understand where they are leaking revenue from customers.

For example, an investment app can quickly learn how user-friendly their trading interface is by analyzing the data on the number of average transactions made.

Using business intelligence, fintech firms can make it easier for customers to access more of their services in a more intuitive way – like how MoneyLion updated their app interface to provide faster access to information as well as streamlining the process of applying for personal loans.

Fintech firms can collect user experience data on their websites or apps using tools such as Google Analytics and utilize business intelligence to correlate this with other internal data related to user transactions and revenue.

This allows companies to understand how best to improve the user experience and minimize revenue leakage.

6. BI helps Deliver Better Personalized Marketing Campaigns

Every customer is unique and has different preferences. The ability to analyze these data is a golden opportunity for fintech companies to intimately learn the motivations behind their users and what truly drives them.

For some, it could be the security of loss-risk investing while others might be attracted to the convenience and easy usage of the platform

Business intelligence can help you to craft personalized marketing messages that will showcase relevant information that will resonate with your different customer types.

Fintech companies will be able to answer important customer discovery questions such as:

“What is the age range of our most active investors on our app over the last 3 years?”

“What are the most popular services used by revenue earned on our platform?”

“What are the main transaction reasons for money transfers on our platform?”

Through detailed insights from business intelligence, fintech companies can launch hyper-specific customer campaigns. This allows them to maximize their marketing dollars and effectively lower their cost of acquisition.

Make Smarter Data-Driven Decisions & Stay Ahead Of The Pack With Business Intelligence Today

The race for growth in fintech is an exciting journey, but one that has to be done intelligently to prevent losing market share to competitors or run into regulatory issues with government agencies.

A robust business intelligence solution will allow organizations to effectively analyze their data and deliver accurate insights to business leaders without the need to go through a steep learning curve.

With Qbo, fintech companies, big or small, can gain insights on-demand from their data by just simply asking questions as you would in a normal conversation.

Embark on a free 14-day trial and experience what business intelligence can really do for your company.