8 Minutes

8 Minutes

7 Ways Insurance Companies Can Benefit From Business Intelligence

The insurance industry has always relied on data and analysts to ensure profitability while treating their clients fairly when it comes to payouts and premium charges.

From actuarial data to customer claims data, insurance companies are no strangers when it comes to crunching numbers and creating predictive models to better price their policies and develop new products for their customers.

According to Deloitte, due to the COVID-19 pandemic, insurers globally have suffered a significant impact on their bottom lines. Life insurance premiums are projected to decline by up to 8% by the end of 2020 with almost all annuity sales taking double-digit declines compared to 2019.

As we move towards an increasingly connected age ripe with disruption, traditional insurers will be facing new and unique challenges that include the rise of insurtech fintech firms as well as a newer educated generation that are taking personal control of their investment future.

Insurance companies will need to use the wealth of data they generate daily to optimize their business processes, develop smarter products, and better delight their customers to stay competitive.

Thankfully with business intelligence, insurers will be able to leverage their mountain of proprietary data to gain valuable insights to unleash innovation and greater profitability in their business.

Insurance – A Data Heavy Industry Facing Challenging Times

Insurance has traditionally been a data-reliant industry with expert teams, systems, and processes to derive value from the streams of data they get.

Data that is used to determine:

- The premiums and payouts of policies

- Commissions to their insurance brokers and partners

- Instances of insurance fraud and bad claims

However, this is not nearly enough.

As we move into an increasingly interconnected digital world shaped by the pandemic, insurers have to adapt to a world of shifting customer behavior and increased competition from new entrants with lower operating costs.

Based on a study by Deloitte, customer demands have evolved, with over 45% of consumers highlighting the offering of non-insurance products as the most important deciding factor.

In addition, it is predicted that by 2024, 33% of premium volume will come from brand new products and offerings.

Insurers will need to better listen to their customers and develop attractive and relevant products that appeal to the needs of today’s consumer.

With the shift to remote working, insurers will also have to re-strategize the current way they are engaging with their customers, the level of customer service being rendered, and how their products are being distributed.

Financially, PWC has also highlighted that it is critical for insurers to assess their revenue, profitability, liquidity, and solvency in different test scenarios to better protect themselves against black-swan events and any regulatory compliance issues.

Through the power of business intelligence, insurance firms will be able to effectively revolutionize their traditional business models, better serve their customers and future-proof themselves in today’s rapidly changing business environment.

In this article, we will be taking you through seven use cases of how insurance companies can utilize business intelligence to innovate ahead.

7 Ways Insurers Can Benefit From Business Intelligence

1. Better Risk Management & Underwriting

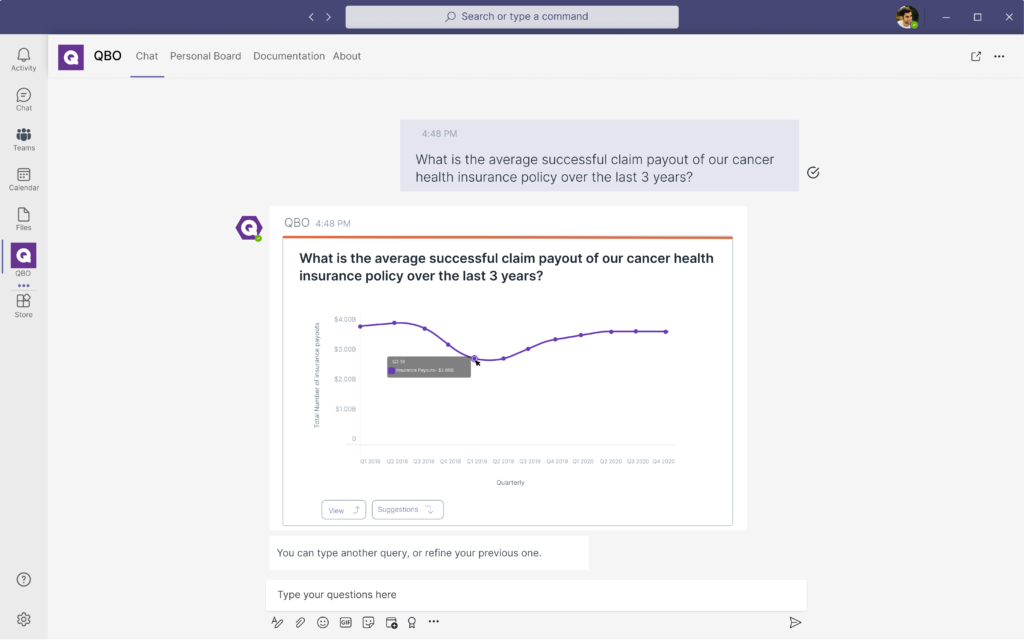

While insurers are staffed with expert actuaries and statisticians who work to support their underwriting and risk management decisions, there are still aspects of underwriting and risk management where they can benefit from using business intelligence.

In today’s world of data deluge, insurers can benefit from BI to gain actionable insights to better improve their predictive and statistical models for better accuracy.

This can be done by asking insightful questions directly to their proprietary data such as:

“What is the percentage of premium defaults for our wealth endowment policy over the last 12 months?” “What is the average successful claim payout of our cancer health insurance policy over the last 3 years?”

With business intelligence, agents themselves will be empowered to pull out insights on demand to gain an accurate visualization of key metrics and trends such as the cost ratio, policy sales growth, and cost per claim so that they may decide whether this is helping their commissions and achieve business targets.

This also allows insurers to better price premiums more competitively to be fair to their customers (and attract new ones) while still earning a healthy profit.

As we move into the world of IoT, insurers can leverage the power of business intelligence to extract actionable insights for their predictive modeling.

As of yet, insurers have used IoT capabilities to simplify underwriting and claims processing. However, new IoT-based models are emerging that are highly attractive to insurers. One such example is that of auto insurers who have historically relied on surface-level data like age, address, and credit-worthiness of their clients. With IoT, they can use telematic sensors to mine driver behavior and use such as the type of vehicle, braking, acceleration, average speed, how often it is driven at night and comparing them with the existing policyholders.

Working together with auto-companies, insurers will be able to better assess a new individual policy applicant to place them in the right auto-insurance band for accurate coverage premium pricing. This is beneficial for customers as well – rather than paying for something that might indicate a risk, they only pay for what is actually a risk based on their own driving performance.

2. Deliver Better Customer Service

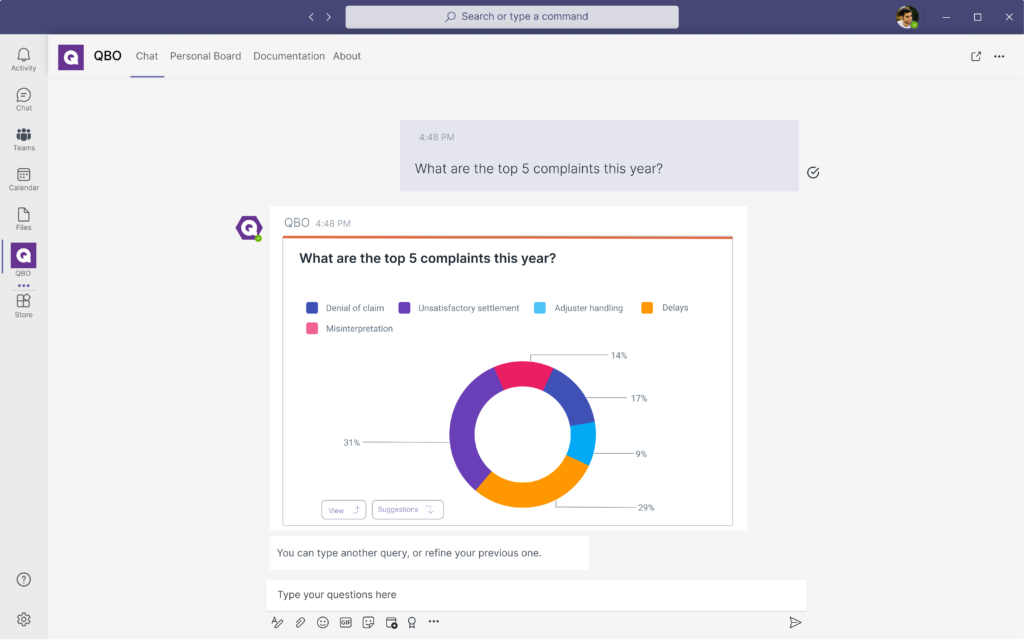

57% of insurers believe that access to friendly and knowledgeable staff is the most effective way to maintain customer loyalty. At the heart of every successful insurer is a dedication to excellent customer service.

With business intelligence, insurers will be able to identify key issues that their customers are enduring and take pro-active steps to address them.

One great area of application is with customer service and feedback data from both their customer portal and call-centers.

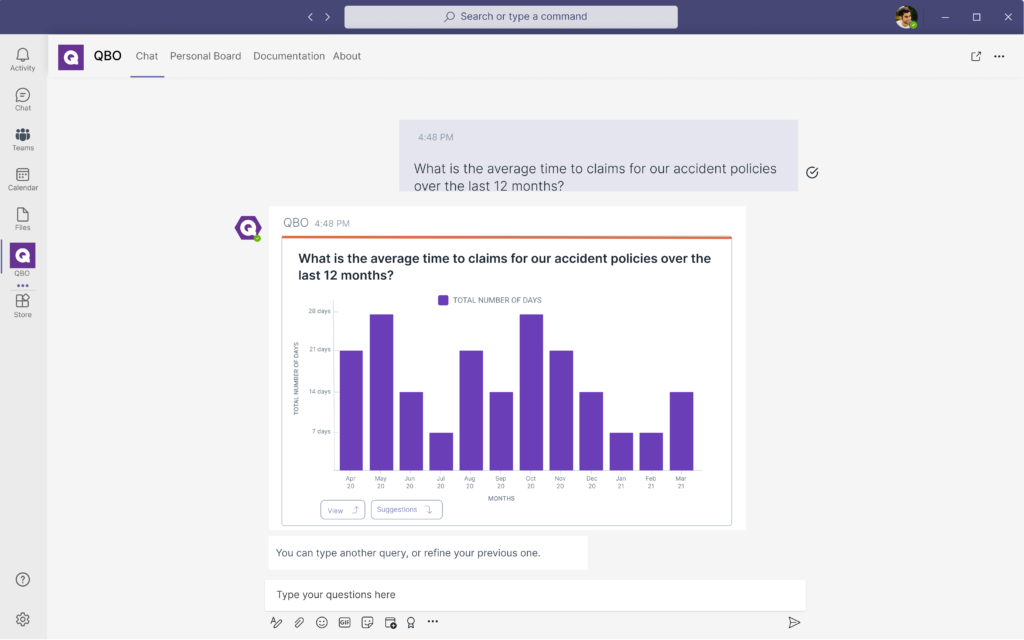

With business intelligence powered by conversational analytics, insurers can ask questions directly to their data such as:

“What are the top five most frequent complaints our customers have when calling our hotline?” “What is the average time to claims for our accident policies over the last 12 months?” “How are customers paying for their premiums?”

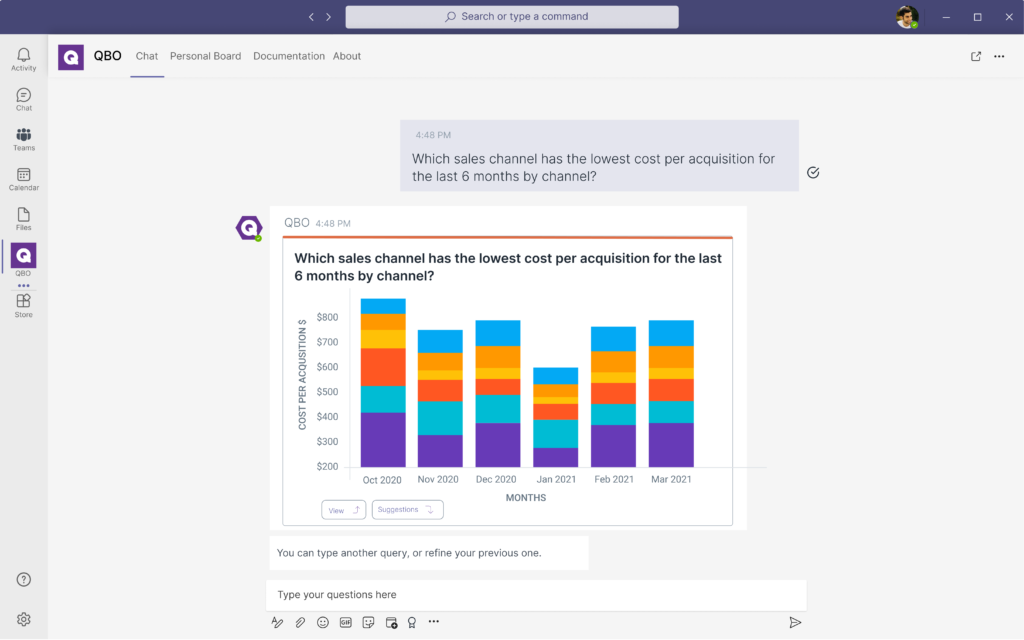

3. Identify More Profitable Distribution Channels

Insurance companies have various outlets where they sell their policies. These include the traditional insurance agents, independent consultancies, banks, and their very own online portal.

However, how profitable are each of these channels, and are the remuneration correctly scaled to the level of business being delivered?

Since 2017, over 180 insurance firms globally have been partnering with technology and insurtech companies to reach a bigger market.

But are these partnerships creating real value that will grow over time for insurers? Are they overinvesting time and effort or should they double-down on their partnerships?

Utilizing business intelligence, insurers will be able to accurately measure key sales metrics of their distribution channels by asking questions directly to their data such as:

“Which sales channel has the lowest cost per acquisition for the last 6 months?” “Which sales channel has the highest monthly revenue growth over the last year?”

Through these insights, insurers will be able to better optimize their sales efforts and resource allocations to the sales channels.

4. Develop Innovative Products & Offerings

Insurers today will need to establish a process that helps in developing products that their customers want.

While customers today might be receptive towards long-term endowment plans, the customer of tomorrow might be more interested in short-term investment-linked policies.

Effective product development will require insurers to harness their data across different business units and gain a deep understanding of what is working and what isn’t.

With business intelligence, insurers will be able to ask insightful questions to their data across different business functions such as:

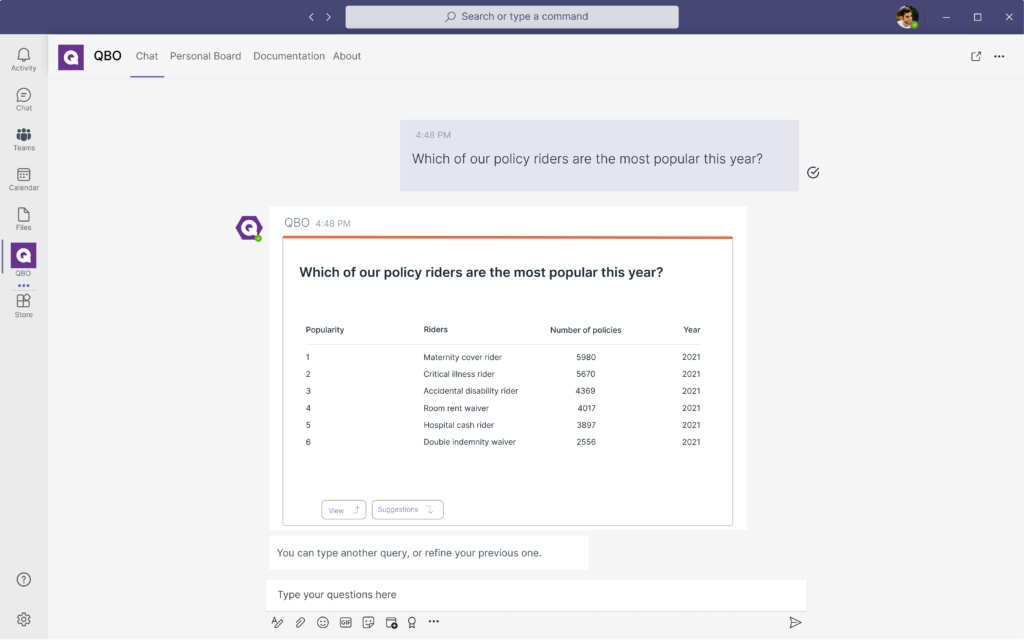

“Which of our products have the most sign-ups over the last 12 months?” “Which of our policy riders are the most popular this year?” “Which are the biggest financial health challenges facing our customers over the last decade?” “What percentage of our savings plans are annuities versus lump-sum payments?”

Getting answers to these key questions allows insurers to get a clearer picture of their customers’ wants and needs, allowing them to cross-reference them with external drivers such as market trends to create truly innovative products.

5. Better Identify Fraud & Minimize Insurance Claims Losses

From married couples attempting to double claim on a policy to fake travel insurance claims, insurance fraud is costing the industry more than $40 billion a year (and that is excluding health insurance).

While the insurance companies take a loss, many times this financial hit is passed on to legitimate consumers in the form of higher premiums and smaller payouts.

This results in a poorer customer experience and leaves companies open to competitors that might have the financial capacity to absorb such a risk and outprice them.

Thankfully with business intelligence, insurance companies will be able to carry out pre-emptive fraud detection through predictive analysis.

Business intelligence will allow insurers to utilize predictive analytics to swiftly identify suspicious claims early in the claims process.

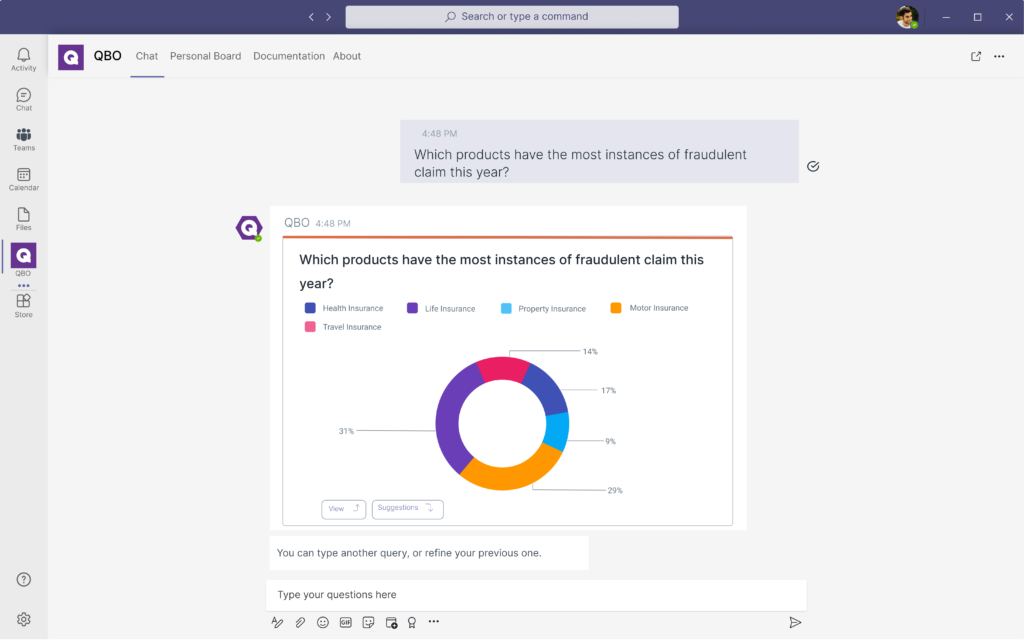

Users will be able to ask questions to their claims data such as:

“Which products have the most instances of fraudulent claims?” “For our home insurance coverage, what is the average claim payout over the last 5 years?”

These insights will allow insurers to create better predictive modeling that will help them better identify a fraudulent claim when it happens, or even better – pre-emptively identify a high-risk applicant.

6. Better Upsell & Cross-Sell Relevant Products To Existing Customers

The best customers are usually your current customers.

Insurers regularly upsell and cross-sell their products to existing clients and with business intelligence, companies and agents will be able to better identify opportunities to capitalize on.

A business intelligence tool will allow you to quickly identify segments of customers that have one insurance type but are lacking in another complementary type.

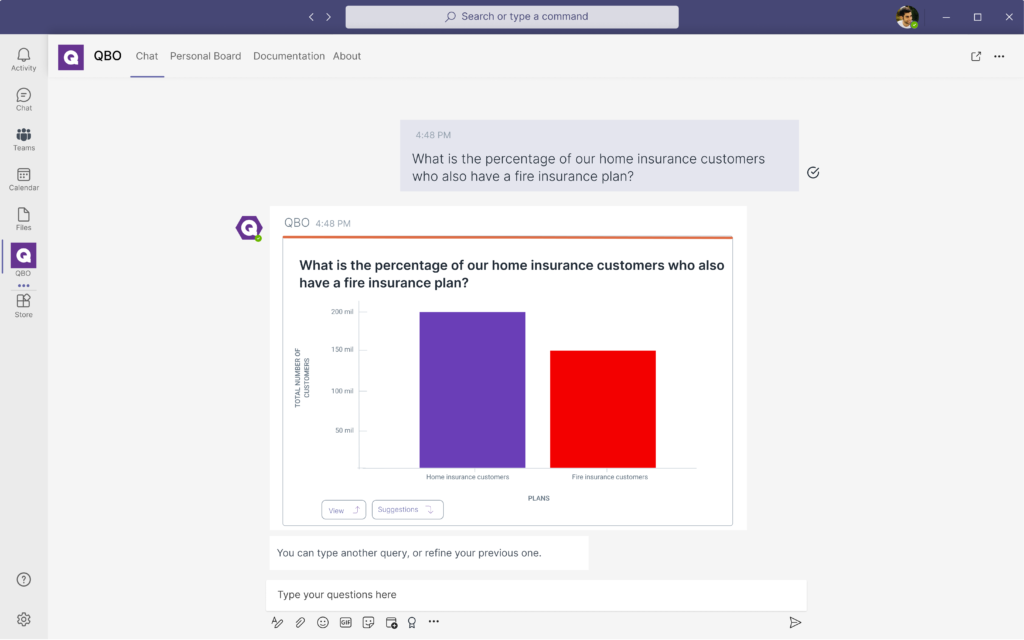

For example, you can ask questions to your data such as:

“What is the percentage of our home insurance customers who also have a fire insurance plan?” “Do the majority of our life insurance customers possess an endowment plan from us?”

Insights from these questions will allow insurers to effectively streamline their cross-selling efforts to not only increase the probability of a sale for their sales teams but also help their marketing departments to create innovative bundled plans for new customers.

7. Identify Highly Profitable Customer Segments For Marketing Campaigns

As insurance firms are increasingly reaching their target customers through digital marketing platforms such as Facebook and YouTube, business intelligence is a powerful tool to identify highly profitable customer segments to target.

With the ability to market to very specific demographics, interests, and even social groups, insurers will be able to tap into their wealth of customer data to identify:

- The most popular policies with the highest profits

- Customer types with the lowest cost of acquisition

- Prospects with the highest lifetime value

Using a business intelligence tool, insurers will be able to ask questions directly to their marketing data such as:

“Which type of customers should we be targeting for the best cost of acquisitions?”

“What are the demographics of customers we should target to sell our life annuity plan?”

“What type of content resonates the most with our subscribers and fans below the age of 25?”

Through these insights, insurance companies will be able to create better-targeted campaigns and highly customized content to cater to the different customer segments and focus more on the ones that drive the most profit.

Innovate Better & Delight Your Customers With Business Intelligence

While the insurance industry might be facing fierce competition and disruption, through the power of data and insights, insurers have the opportunity to stay ahead of the game.

At Unscrambl, we developed Qbo, a business intelligence tool powered by conversational analytics. This allows users to gain insights into their data by simply asking questions conversationally.

Start your free 14-day trial today and begin to optimize and revolutionize your organization with data-driven decision-making.