9 Minutes

9 Minutes

Reducing Customer Churn for Telcos – A Data-Driven Approach Powered by Business Intelligence

Letting go of someone who’s been with you for a while is hard. Especially if they’re long time, regularly paying customers. But it happens very often, across all kinds of businesses. As the world moves towards the era of 5G, players in the telecom industry are facing the dual challenges of innovating ahead while ensuring their customers are satisfied with their offerings.

Wireless and mobile broadband penetration is growing fast in markets across ASEAN with countries like Indonesia whose mobile penetration rate is estimated to grow from 64% in 2017 to 69% by 2025.

With mobile operators fiercely trying to differentiate themselves by offering more competitive rates and bundled services, customer lifecycles are shortening and brand loyalty is waning.

Even before the COVID-19 pandemic swept across the globe, the customer churn rates were a clear and present challenge. According to Yessie Yosetya, CTO at XL Axiata, the churn rate in Indonesia’s telco market is at 20% – a significant figure.

Given the challenging landscape today fraught with new disruptors challenging incumbents with innovative business models, new pricing strategies, it has never been more urgent for telecom companies to understand the driving factors of their customer churn and take steps to reduce it.

In this article, we will take you through the key drivers of customer churn and how a data-driven approach to churn management can help telcos reduce churn by up to 15%.

In the telecom industry, this act of customers ceasing to do business with the operator is termed as attrition, or simply ‘churn’. Churn is one of the key business metrics tracked and there are continuous ongoing attempts to eliminate or minimize it. Churn is measured as a percentage of the customers discontinuing their services out of the total number of customers that the provider has at any given time.

Churn is an issue of major concern for all stakeholders, as it affects telcos’ revenues, profitability, and survival as well as questions quality service delivery in competition, which in turn, enhances the satisfaction of subscribers. Consider these alarming numbers:

- Based on a churn rate just under two percent for top companies, one source estimates carriers lose $65 million per month from churn

- Computer Weekly cites, mobile operators spend approximately 15 percent of their revenues on network infrastructure and IT — but a whopping 15 to 20 percent of revenues on the acquisition and retention of customers

- A Canadian study found out that it costs nearly 50 times less to retain than acquire a customer

Understanding the Internal & External Drivers of Churn

While there are a multitude of factors that affect if a customer will stay or leave, there is a collection of key drivers that every business leader needs to track and monitor.

Every month (sometimes every week), specialized ‘Retention Teams’ calculate the churn rates, and slice & dice the data of churners across hundreds of dimensions, to understand what parameter is responsible for this phenomenon. The goal is to minimize churn by improving all the areas where the telco might be causing a customer to be dissatisfied.

But, it’s not that straightforward. A customer may have many reasons to churn. It may be due to higher pricing (as compared to competitors), billing issues, the inability of customer service teams to resolve the customer’s problems, better promotions by competitors, or network-related problems. Sometimes, customers might also attrite because of getting too many marketing messages or if there’s a better offer for new customers within the same telco provider.

Now, it’s really difficult to pinpoint what was the last straw for a churned customer. The reason can be both due to internal factors or external (competition). Some customers have a higher level of tolerance while others don’t. And that’s where the subtle changes in customer behaviors come into play. If analysts and business users can try out multiple hypotheses involving changes in the behavioral metrics of customers, they would be able to narrow down to a few core reasons why a certain set of customers have churned or are about to.

Internal Drivers:

These are drivers that are internal to a mobile operator where the data can be tracked, measured, and analyzed.

1) Involuntary Churn

Involuntary churn happens when a customer’s payment attempt fails, where this is through a credit card payment or a bank deduction, leading to a subscription cancellation.

To better understand and track your involuntary churn, it is key for managers to track KPIs that include payment delinquency or the non-payment rate.

2) Voluntary Churn

Churn happens when customers are unhappy with the product, service, or generally the experience of the brand and decides to stop becoming a customer.

In the telco industry, this can happen for a variety of reasons such as plans expiring and former customers hopping on to a new exclusive deal, or it could also be a drop in mobile data quality causing dissatisfaction. Often this is measured by KPIs centered around customer satisfaction.

These include:

- Net Promoter Score (NPS)

- Customer Satisfaction Score (CSAT)

The Net Promoter Score can be calculated with this formula:

NPS (%) = [(Responses from promoters – Responses from detractors) / Total Responses] x 100

While your Customer Satisfaction Score can be calculated with this formula

CSAT (%) = (Number of positive responses / Total responses) x 100

3) Network Quality

Your network quality is your product quality.

An operator’s detailed analytics has revealed that customers that experienced more than 10 dropped calls in a month were 8 times more likely to churn.

If the churn is caused by a network quality issue, telco managers will be able to effectively identify the exact cause of the issue, which could be a damaged cell phone, poor reception, or issues with the communications tower.

To accurately track this driver, telcos will have to keep an eye on and manage their dropped-call rate (DCR) as well as their call-completion rate (CCR).

4) Acquisition

Churn also happens when the wrong customers have been acquired.

This is a common consequence that occurs in marketing or sales when a customer signs-up for a plan that isn’t best suited to their needs and eventually terminates the contract.

This is where measuring your customer churn rate for specific services or bundles to identify which has an acquisition problem.

To calculate churn rate, simply use this formula:

Churn rate (%) = [(Customers at the beginning of the month – Customers at the end of the month) / Customers at the beginning of the month] X 100

5) Customer Service Issues

Regardless of industry, customer service has always been an internal driver that affects your customer satisfaction and this is doubly so in the telecom industry where communication services are a necessity.

From issues reaching the call centers to the actual resolution of the customer’s problems, keeping your customer service issues to a minimum is key.

This can be done by firstly tracking KPIs that include:

- Turn-around time for issue resolution

- Average reply time

- The time to first response

- Ticket backlog

- First contact resolution rate

All these are long-tail KPIs that affect churn due to customer service issues and should be constantly monitored by your team.

External Drivers:

These are drivers that are harder to track but still are noteworthy for telcos to pay attention to as it affects customer churn.

A) Competition

From pricing changes to new product launches, telcos are always in a state of flux where even the slightest change can cause customers to try another service provider.

B) Regulatory Changes

From the awarding of new telco licenses introducing new competitors to higher taxes borne by the consumer, these are factors that also contribute to customer churn.

Utilizing Conversational Analytics to Manage Customer Churn – 3 Ways How

Reducing customer churn starts with tracking, monitoring, and analyzing the data of your internal drivers’ KPIs.

With so much understanding and knowledge of churn within telcos, and corresponding retention practices in place, the only limiting factor is the availability of timely and relevant data and insights. If the decision-makers are empowered with all the information they need to understand key churn drivers and ‘why’ churn is happening, they will be in a better position to prevent it proactively.

This is where technology plays an important part. AI-driven analytics tools can mine massive amounts of data related to churn and associated customer data, and push them to decision-makers to take appropriate and relevant action. The simplicity of querying all the transactional and profile data in simple, conversational language can enable non-technical business users to get a better understanding of the business metrics and contribute better to the overall performance of the business.

This can be done by utilizing a business intelligence tool powered by conversational analytics such as Qbo.

This empowers people in your organization to simply ask questions about the data and gain valuable insights to understand why customer churn is happening.

1) Start With What You Want to Measure & Start Tracking Them

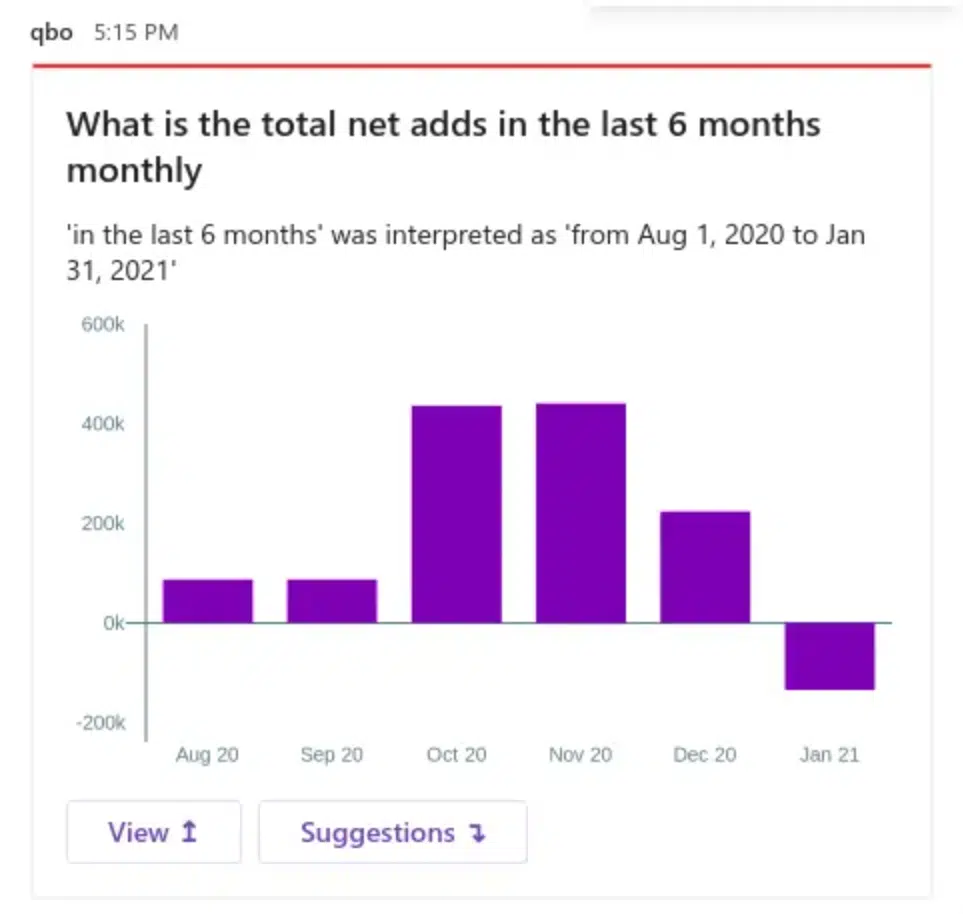

For example, The chief commercial officer is concerned about falling Net Adds and wants the team to improve it, he will be able to ask questions directly to their data such as:

“Total Net Adds Trend in the last 6 months”

The conversational analytics solution will immediately analyze all the data and return with answers on-demand.

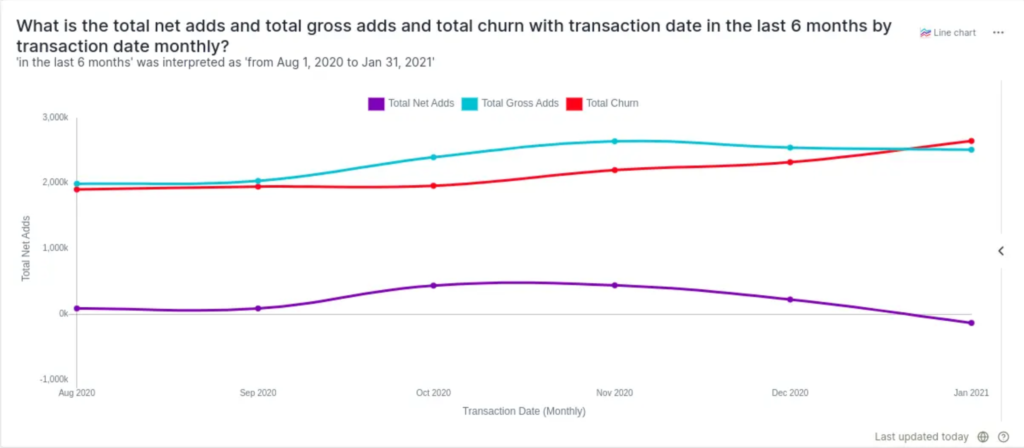

You can also show the feature of adding attributes on the board and add Gross Adds & Churn.

You’ll also be able to drill-down queries to gain deeper insight to identify growing problems within that internal driver by defining time frames and asking comparison questions such as:

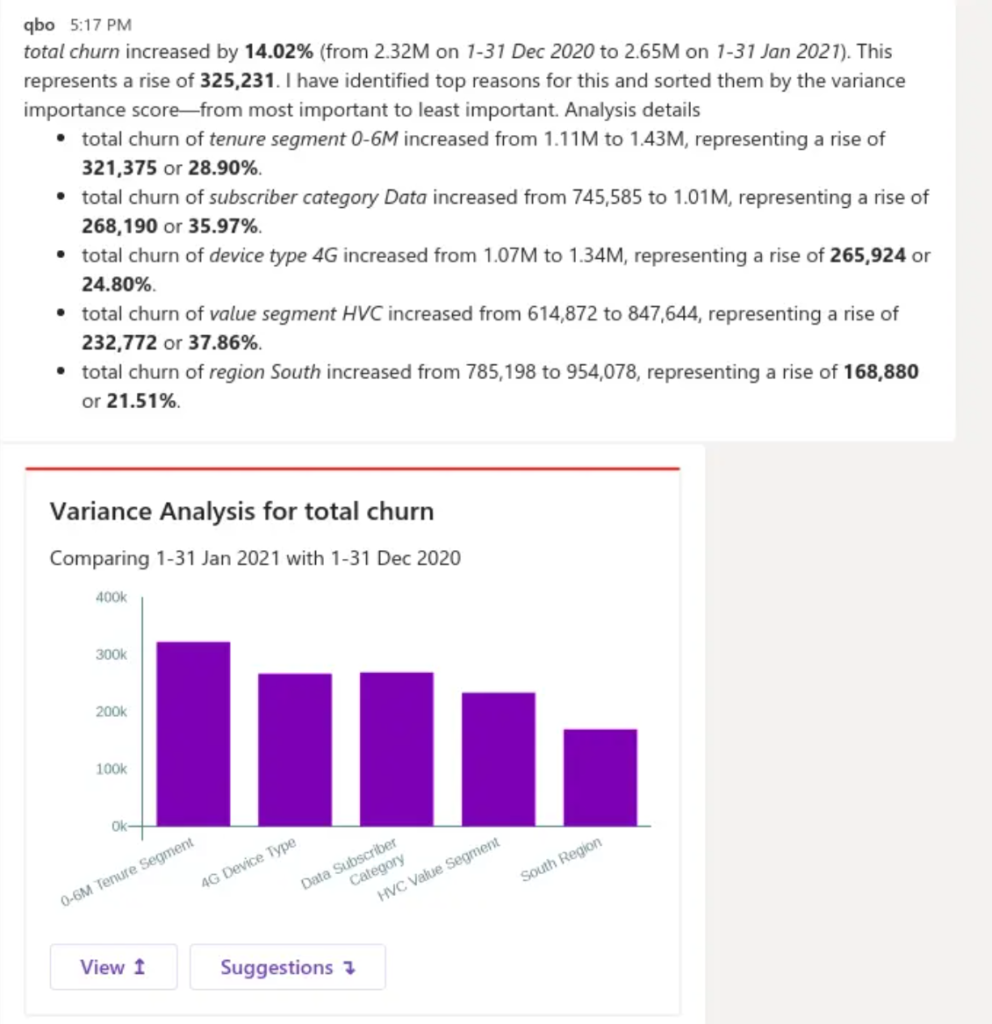

“Why did the churn increase in the last month over the previous month”

2) Ask Insightful Questions to Gain a Deeper Understanding

While understanding trends are essential, discovering why your customer churn increased or decreased is just as important – and that is made possible thanks to the power of conversational analytics.

With Qbo, you’ll be able to effectively pinpoint areas or points in time when your customer churn rate is exceedingly high.

By firstly identifying a period of high customer churn, that same time-frame can be used as a basis to ask more questions to your data to discover the root cause that is causing the churn.

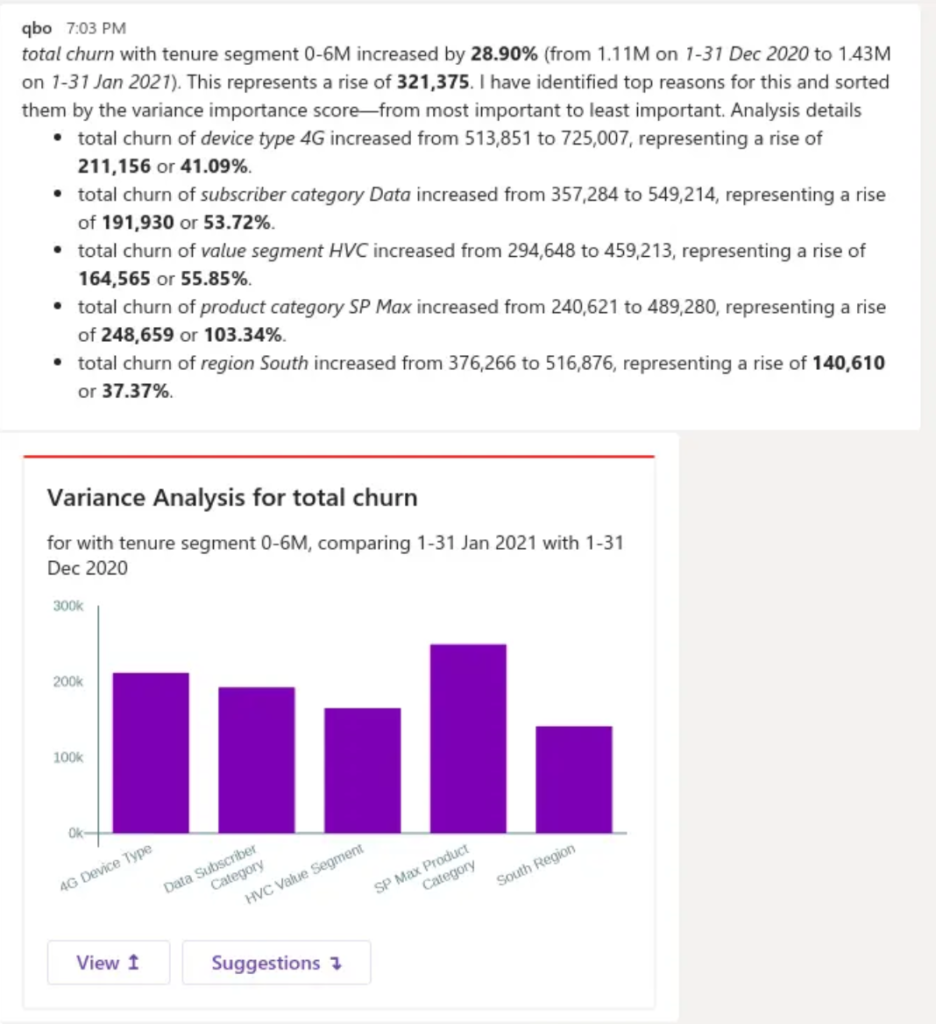

For example, Once you get your first set of data, you are left with more questions and end up extracting data multiple times before concluding. Qbo, with its AI capabilities, is able to identify the reason and complete the analysis instantly. More time to be spent on planning and implementation rather than finding the relevant data, users will be able to ask their data diagnostic questions such as:

“Refine and show for Tenure Segment 0-6 Mths”

Qbo keeps the context of the previous question, and you can drill down further just with a simple question:

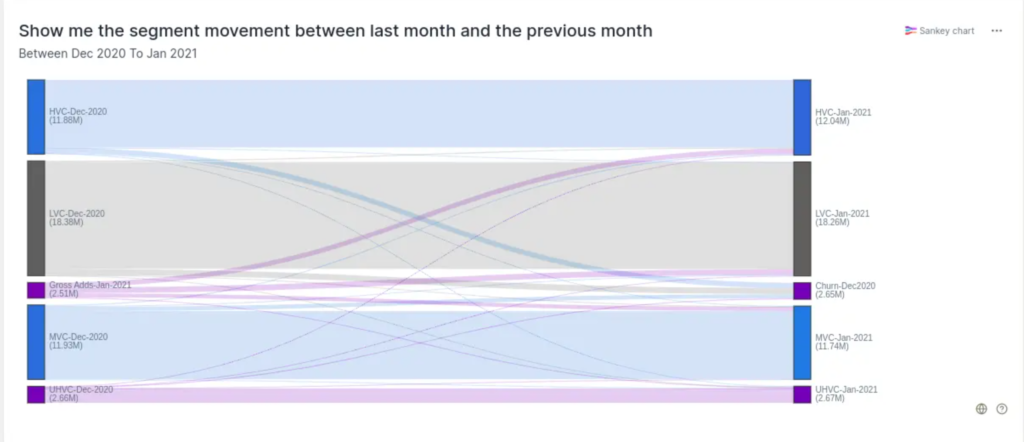

“Show value segment movement from Dec 2020 to Jan 2021”

All these questions and the insights delivered to allow you to gain a deeper picture of areas you need to improve throughout your organization to reduce churn.

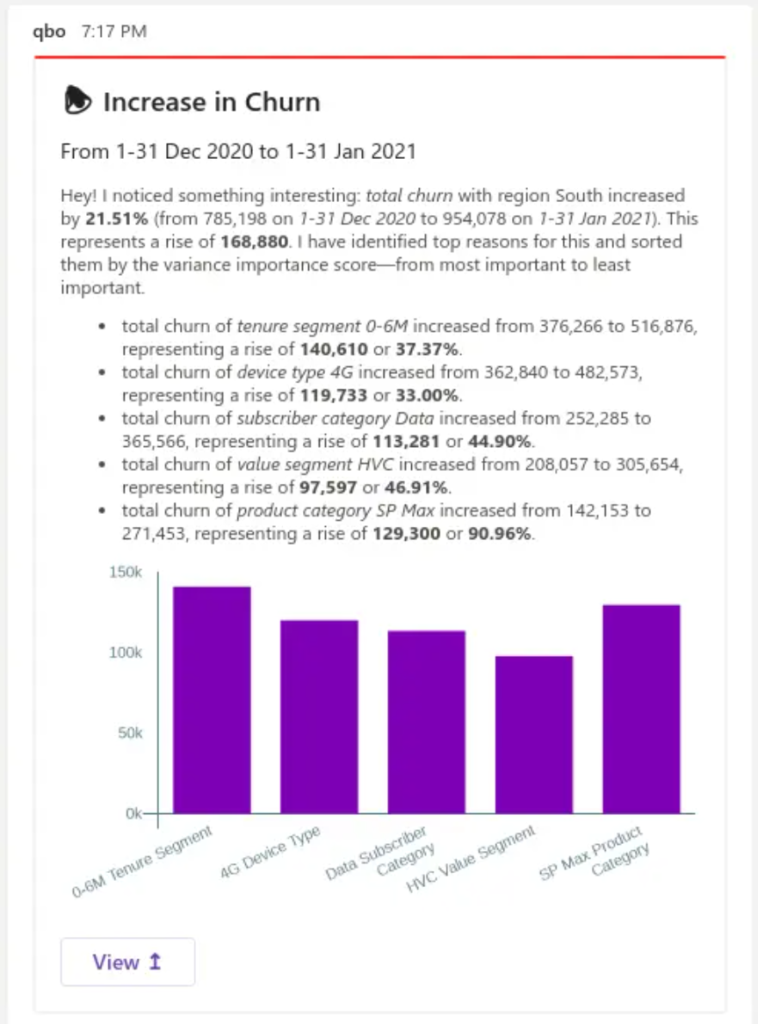

3) Gain Automatic Insights & Alerts from Machine Initiated Conversations

Utilizing Qbo, you’ll be able to gain pre-emptive insights without even initiating a conversation.

With our machine-initiated conversations feature, our conversational analytics tool will automatically inform your users when important KPIs or metrics relevant to their role and persona have changed.

For example, if the churn rate suddenly spikes in a given week. Our platform will automatically initiate a conversation to engage with you, inviting you to learn more and dive deeper into the analysis or fact.

As users continually interact with our platform, our tool will also learn when to initiate (and when not to) a conversation and on what topics.

Conversational analytics allows you to proactively gain insights into your data, especially when you are busy handling other areas of your business if the situation is urgent enough.

Effectively Manage Your Customer Churn with Qbo

Reducing churn is key to sustaining long-term growth for telecommunication companies and service providers.

Operators will need to embrace a data-driven approach to effectively diagnose why customer churn is happening, the key KPIs to track as well as the approach needed to rectify it.

With business intelligence, powered by conversational analytics, teams and departments across the organization will be able to make data-driven decisions to better optimize the business processes.

Embark on a free 14-day trial of Qbo today and start gaining actionable insights from your data.