2 Minutes

2 Minutes

UnionBank Takes Honours at Global Retail Banking Innovation Awards 2019 for Unscrambl-developed Technology

MANILA, Philippines, Dec. 3, 2019 /PRNewswire/

Unscrambl’s qbo CX, an AI-powered contextually-aware and location-aware chatbot developed for UnionBank, wins Highly Acclaimed Chatbot Service.

Unscrambl, the company democratizing data discovery and insights consumption to accelerate the way businesses make decisions, announced today that its partner, Union Bank of the Philippines (UnionBank), has received the award for Highly Acclaimed Chatbot Service at the 2019 Global Retail Banking Innovation Awards in Singapore. Unscrambl developed the chatbot to enhance customer experiences for UnionBank.

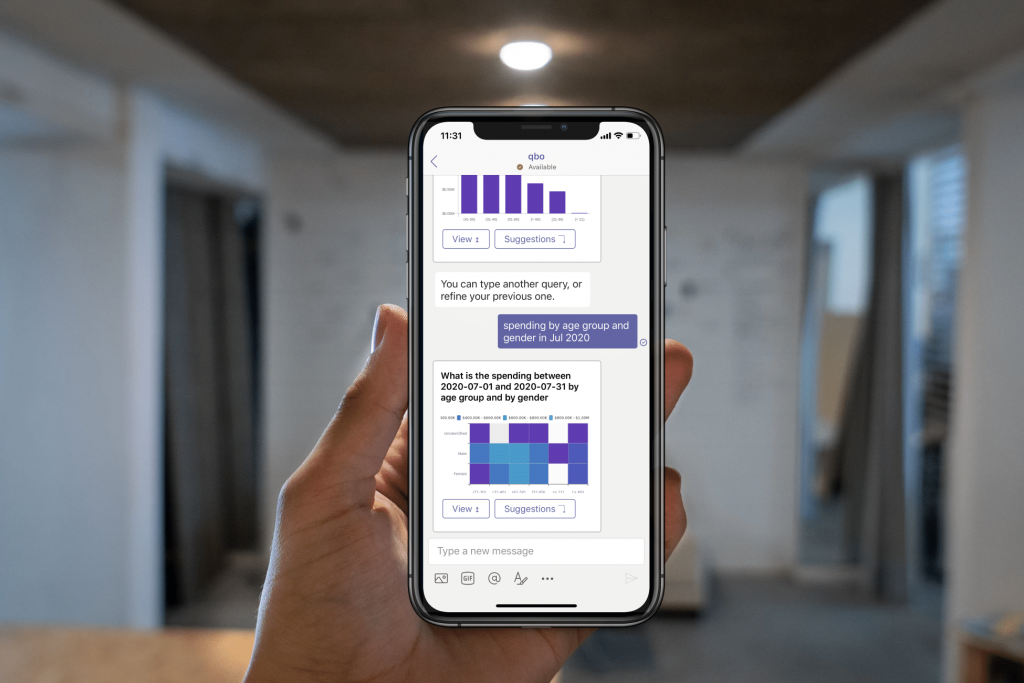

The chatbot, called qbo CX from Unscrambl, combines the latest technology in real-time analytics, Natural Language Processing (NLP) and Artficial Intelligence (AI), providing the bank’s customers a cutting-edge customer experience. qbo CX integrates with customer-facing channels like Facebook Messenger as well as the bank’s own systems, and provides a truly personalized, contextual and conversational experience. This means that customers can converse naturally with qbo CX, and the bot can in turn deliver useful services such as helping customers make payments, finding the nearest branch or telling them their current account balance. qbo CX understands how the customer arrived on the chatbot – whether they clicked through an email or an ad – and adds information to the customer’s profile throughout the conversation. qbo CX provides detailed telemetry about user behaviour, helping Unionbank optimize their conversations with customers, and learning about customer preferences.

“We’re thrilled that UnionBank was able to achieve this honour based on the technology we customized for them,” said Vibhore Kumar, CEO of Unscrambl. “qbo CX has become a valuable virtual employee available 24/7 for the bank, engaging in more than 15,000 conversations each month, and delivering 90 percent NLP accuracy. The best news is that abo CX is now available for other businesses that are in need of assistance with customer acquisition or customer support.”

Benefits of qbo for business are numerous and include:

- Customer service available 24/7 for customers on favourite messaging platforms like Facebook Messenger.

- Frustration-free, intelligent conversations leveraging AI and NLP to improve comprehension and response over traditional chatbots.

- Automation of a variety of resource-intensive processes, including responding to customer queries, making relevant product recommendations, onboarding users and executing service requests.

- Go live rapidly and at scale with an out-of-the-box library of intents and Machine Learning algorithms.

- Lead the conversation with content that is contextually relevant to the user’s visit, while building up the user’s profile.

- “Unscrambl not only delivered a platform on time and within budget, but also enabled us to think outside the box in terms of the capabilities and services that could transform our business. In short, they are the definition of an innovative tech partner,” says Rafael M. Aboitiz, Digital Engagement Head of UnionBank.

Organised by the Digital Banker, the Global Retail Banking Innovation Awards confers accolades of excellence and distinction to industry players that are setting new standards of service delivery, digital innovation, product developments, payments, technology, and customer experience.

Previous Posts

XL Axiata Collaborates with Cloudera To Increase The Use of Data Analytics to Drive Business Performance

Read

November 16, 2020

Read

November 16, 2020

Microsoft Teams adds new apps and power tools for improved user experience

Read

July 29, 2020

Read

July 29, 2020

Unscrambl integrates with Microsoft Teams to let users converse with enterprise data

Read

Read